The introduction of the 'plastic ban order' ushered in explosive growth, and the degradable plastic market is expected to achieve a revenue of 50billion yuan in 2025

2021-06-17 09:49:59 source: Chen Yu company author: Xing Menglin, Huang Yingjiao

Guide: This paper discusses the three keys to entering the degradable plastic market, including 'early layout, focus and cost reduction', in order to provide enlightenment for the future development of relevant enterprises, especially the decision-making and management of enterprise executives.

'White pollution is a huge challenge in the process of human social and economic development. Since the 21st century, there has been a global trend of degradable plastics, and many countries have issued stricter policies to promote the development of the industry. In January 2020, China officially changed from' plastic restriction 'to' plastic prohibition ', which led the degradable plastics industry from the early downturn to the high-speed development period. Due to the long-term sluggish development, the current industry competition is relatively chaotic and has not been finalized. If we grasp the core elements, we may become a leading enterprise and lead the golden age.

This paper discusses the three keys to entering the degradable plastic market, including 'early layout, focus and cost reduction', in order to provide enlightenment for the future development of relevant enterprises, especially the decision-making and management of enterprise executives.

'Plastic ban order' was issued, and the degradable plastic market ushered in a blowout

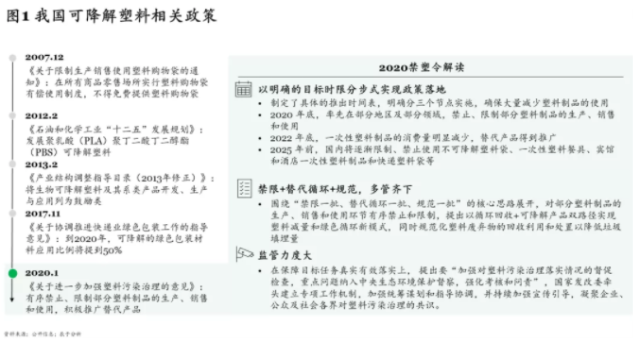

China's degradable plastic market has started as early as 2012, but due to the low market demand in the early stage, high raw material costs, limited production capacity, and the slow development of the industry as a whole, some enterprises that entered the market earlier were even forced to transform due to long-term insufficient orders. Until January 2020, the 'opinions on Further Strengthening the control of plastic pollution' (hereinafter referred to as the 'plastic ban order') was issued, requiring the orderly prohibition and restriction of the production, sale and use of some plastic products, and the active promotion of alternative products, officially changing from 'plastic limit' to 'plastic ban' (see Figure 1).

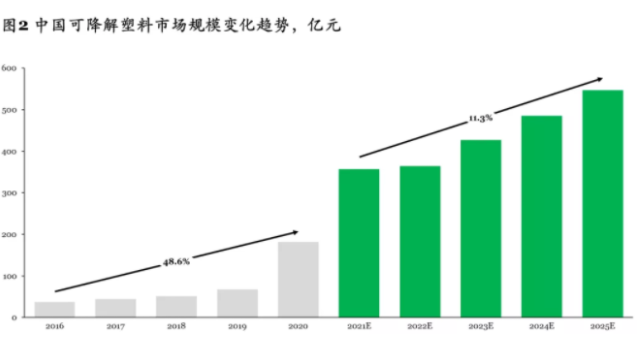

Affected by this, the degradable plastic market, as a substitute for traditional plastics, has increased significantly, and orders have soared. We predict that during the '14th five year plan' period, the degradable plastic market will achieve a compound annual growth rate of 11.3% and a revenue scale of more than 50billion yuan by 2025 (see Figure 2).

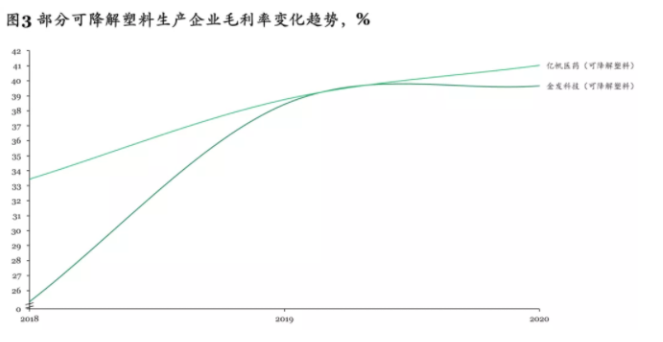

At the same time, the price of degradable plastic products has risen in the past year. For example, the price of PLA was 20000 yuan / ton before the plastic ban, and now the market price in some places has reached 50000 yuan / ton. This has directly improved the overall profitability of the industry. For example, the gross profit margins of enterprises such as Goldilocks and Yifan pharmaceutical in 2019 and 2020 were close to 40%, significantly higher than those in 2018 (see Figure 3).

Third, enter the degradable plastic market

1. Early layout

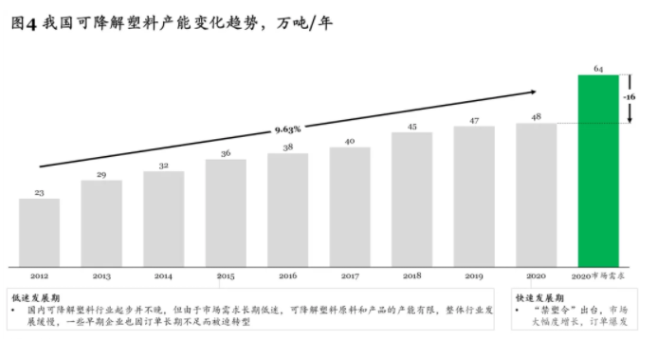

Due to the long-term downturn in the market earlier, the capacity growth of domestic degradable plastics has been slow. According to statistics, the compound annual growth rate of this figure was 9.63% from 2012 to 2020, reaching 480000 tons / year by 2020, and the market demand in the same year was 640000 tons / year, with a large capacity gap (see Figure 4).

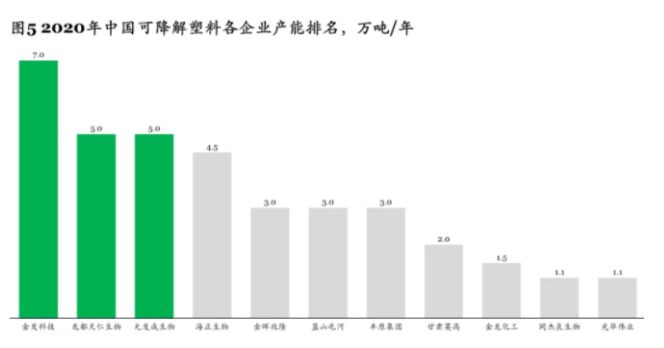

At the same time, the gap between the production capacity of major manufacturers is small. The production capacity of Goldilocks, Longdu Tianren biology and yunyoucheng biology, the top three in market share, in 2020 is only 70000 tons / year, 50000 tons / year and 50000 tons / year respectively. It can be said that whoever can finish the production capacity layout ahead of others is likely to seize the opportunity to obtain a larger share, and it is not difficult for the latter to catch up.

However, 'time waits for no man', and the intensification of competition is inevitable in the future. It is understood that at present, enterprises are actively expanding, and the planned new capacity in the next few years is more than 8million tons / year (of which PBAT, PLA and PHA are 3.48 million tons / year, 3.46 million tons / year and 100000 tons / year respectively). The new capacity that has been determined from 2021 to 2022 alone is as much as 3.7 million tons. In order to solve the problem of capital gap, major manufacturers also take various measures and show their magic powers. For example, Changhong high tech announced the convertible bond issuance plan on May 21, 2021, which plans to issue convertible corporate bonds with a total amount of no more than 700million yuan (including), with a term of 6 years. The raised funds are intended to be used for the 'secondary investment of 600000 tons of fully biodegradable thermoplastic industrialization project (phase I)'; In January 2021, Jindan Technology issued the announcement of the change of raised investment projects. In combination with the 'plastic ban' policy and the future market situation of biodegradable materials, the management of the company believes that it is necessary to appropriately expand the originally designed 10000 ton polylactic acid production capacity. At present, the board of directors of the company is organizing relevant personnel to analyze and demonstrate the feasibility and implementation plan of expanding the investment scale of the project.

2. Focus on key points

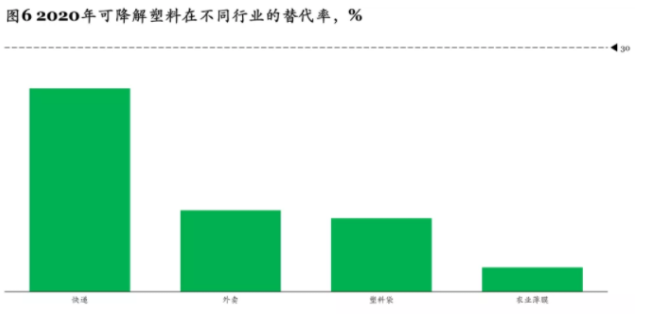

According to the 'plastic ban order' in 2020, there are four types of plastic products that are mainly restricted: plastic shopping bags, disposable plastic tableware, disposable plastic supplies for hotels and express plastic packaging, and the production and sales of ultra-thin plastic bags and ultra-thin agricultural film are also restricted. At present, the replacement rate of degradable plastics in these industries is low, with the highest being 25% of the express industry and the lowest being 3% of the agricultural film industry, both lower than the average replacement rate of 30% in the United States, the Netherlands and other countries (see Figure 6).

However, 'time waits for no man', and the intensification of competition is inevitable in the future. It is understood that at present, enterprises are actively expanding, and the planned new capacity in the next few years is more than 8million tons / year (of which PBAT, PLA and PHA are 3.48 million tons / year, 3.46 million tons / year and 100000 tons / year respectively). The new capacity that has been determined from 2021 to 2022 alone is as much as 3.7 million tons. In order to solve the problem of capital gap, major manufacturers also take various measures and show their magic powers. For example, Changhong high tech announced the convertible bond issuance plan on May 21, 2021, which plans to issue convertible corporate bonds with a total amount of no more than 700million yuan (including), with a term of 6 years. The raised funds are intended to be used for the 'secondary investment of 600000 tons of fully biodegradable thermoplastic industrialization project (phase I)'; In January 2021, Jindan Technology issued the announcement of the change of raised investment projects. In combination with the 'plastic ban' policy and the future market situation of biodegradable materials, the management of the company believes that it is necessary to appropriately expand the originally designed 10000 ton polylactic acid production capacity. At present, the board of directors of the company is organizing relevant personnel to analyze and demonstrate the feasibility and implementation plan of expanding the investment scale of the project.

2. Focus on key points

According to the 'plastic ban order' in 2020, there are four types of plastic products that are mainly restricted: plastic shopping bags, disposable plastic tableware, disposable plastic supplies for hotels and express plastic packaging, and the production and sales of ultra-thin plastic bags and ultra-thin agricultural film are also restricted. At present, the replacement rate of degradable plastics in these industries is low, with the highest being 25% of the express industry and the lowest being 3% of the agricultural film industry, both lower than the average replacement rate of 30% in the United States, the Netherlands and other countries (see Figure 6).

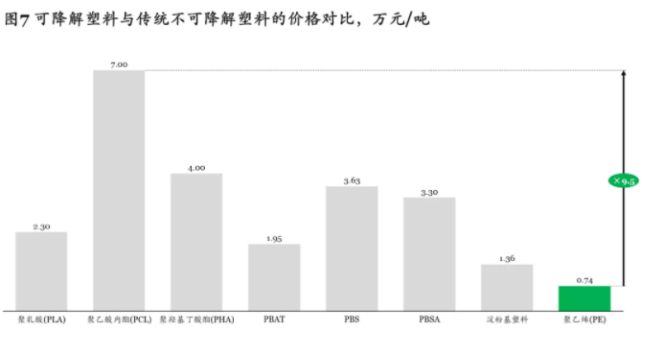

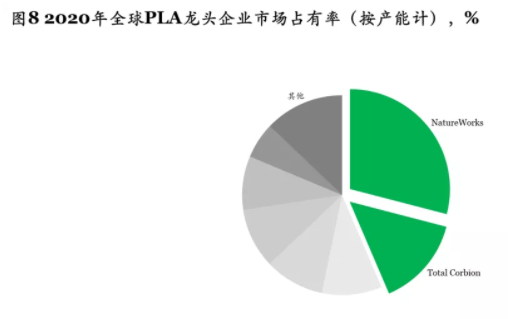

The high price of raw materials, the low level of technology and the low utilization rate of production capacity are the three main reasons for the high price of degradable plastics in China. Taking PLA as an example, although the one-step method has low cost but poor quality, and the two-step method has excellent quality. It is the current mainstream synthesis route, but the cost is high, which is about 2.3 times that of the one-step method. How to achieve high purity and low cost is the key to improve penetration and win market competition: for example, total corbion, a joint venture of NatureWorks in the United States, total in France and corbion in the Netherlands, guides the global market because of its low-cost and high-purity preparation process of lactide, an intermediate for the preparation of PLA. In 2020, its capacity share reached 29.04% and 14.52% respectively (Figure 8).

aking a close look at China, enterprises are also actively breaking through technical barriers through independent research and development, cooperative research and development, etc., in order to obtain cost advantages. For example, Zhejiang Haizheng and Changchun Yinghua Institute jointly developed lactide technology and process, which has been successfully off-line production and achieved partial self supply; COFCO science and technology and gherat, Belgium jointly established a production base of the whole industrial chain of corn lactic acid lactide polylactic acid in Anhui, and have basically mastered the production process and processing technology of lactide. In addition, the Institute of physics and chemistry of the Chinese Academy of Sciences has developed PBAT production technology with low cost, high mechanical properties and good biosafety. Huiying new materials, Jinhui Zhaolong and Yuetai biology and other companies obtained the right to use it through authorization, which also solved the problem of high cost to a certain extent.

Original title: the introduction of the 'plastic ban' ushered in explosive growth, and the degradable plastic market is expected to achieve a revenue of 50billion yuan in 2025

Article link: environmental protection online https://www.hbzhan.com/news/detail/142018.html